All You Need To Know About Ecofibre Limited

In the last few articles we have covered ten of the most promising companies based in the medicinal cannabis sector in Australia, that the investors should look out for. In this article we shall look at a company that is slightly different from the companies that we have covered so far.

If you have not gone through the first two articles, then we suggest that you go through them first. The first two articles looked mostly at companies created within the last ten years and most of the companies hardly had 5 years under their belt. Thus all of the companies that we covered, were very young and in addition to this most of them had products in various stages of development.

Such companies as we have mentioned before, are ideal for investors who are in for the long game. However investors looking to make profits off the short term investment opportunities do not find such companies attractive, as they offer very little opportunity for profits.

Also See: 10 Australian Shares That Have Great Potential

In this article we shall look at Ecofibre Limited which has more experience than any of the companies we covered previously. Th

Ecofibre Limited

Ecofibre Limited was established in 2009 and has therefore had over a decade of operations, the company was listed in the ASX in March 2019. It is a biotechnology company, based off Australia that primarily sells cannabis based products that includes medicines, health and beauty products and textiles in Australia and the USA.

Products

Ecofibre has got the following product offering

- Ananda food: Food grade hemp seed to be used in the Australian food sector.

- Ananda hemp: Hemp based nutraceutical products

- Ananda Professional: Exclusive line of hemp based medicinal products only available through pharmacies.

- Hemp black: High performance textiles

Financials

Market Position

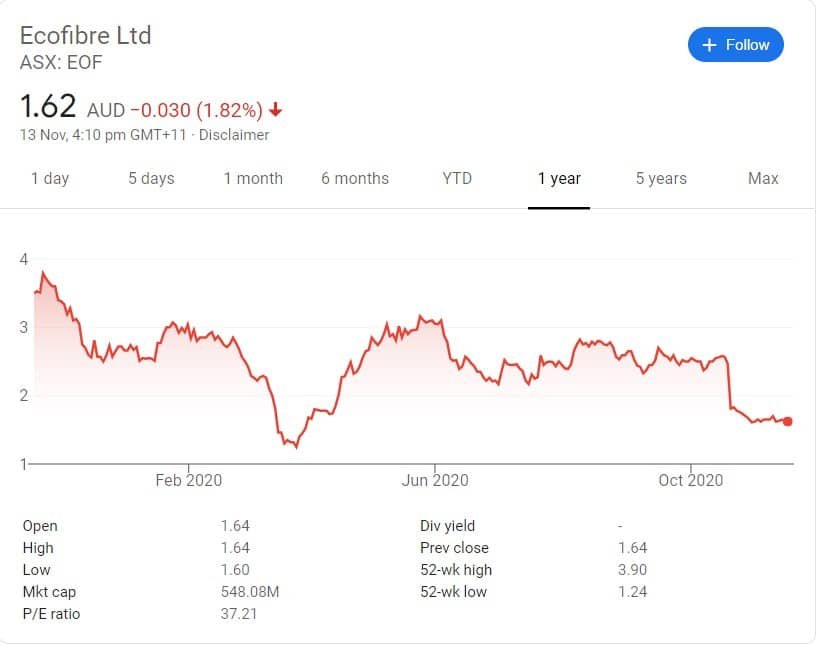

Ecofibre raised up to $20 million as a result of its IPO early in 2019 and since then the share price of Ecofibre has remained largely stable. Although some major troughs can be seen but on the whole it can be seen that the share price has largely tracked closer to AUD 2. The current share price of Ecofibre is AUD 1.78.

Profitability

If we look at the companies in the cannabis sector, then out of all of the companies, Ecofibre has the best looking financials, with fundamental indicators all showing stability. The year June 2020 ended with Ecofibre posting net income around AUD 6 million. Although the sales revenue growth has gone down in 2020, due to the Covid-19 pandemic, still the company managed to post sales figures of around AUD 21.7 million. The gross profit margin of the company is almost 48% which is a very high figure, the net profit margin is roughly 25% which firmly establishes the profitability of the company.

EPS is around ADU 0.04 which if you compare it with companies in other sectors is very low but for the medicinal cannabis sector, this is a high and respectable EPS figure. The return on assets is around 20% and return on equity is 25%, once again very good figures, showing that the company is not just profitable but also financially strong and stable. Any investment in a company with such financial indicators, is safe and bound to give good returns.

Leverage

The leverage ratios are also all under 20%, which shows that the company is staked highly on equity and therefore not very highly leveraged. It is common for companies in other sectors to be highly leveraged, in the bracket of 40% to 60%.

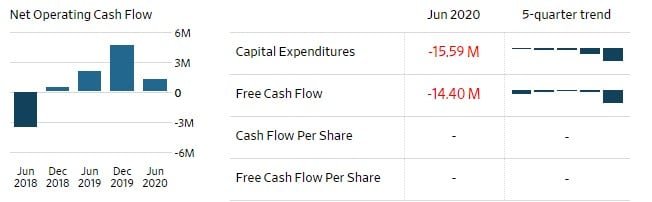

While the company has got very high liquidity ratios, meaning that the company is following the going concern assumption for the foreseeable future, the free cash flow figure is in the negative and is perhaps the only indicator that is not good. Free cash flow refers to the cash available after paying for all the operating expenses for the creditors and shareholders.

Usually a negative free cash flow is complemented by bad liquidity ratios, since this is not the case for Ecofibre, we must look at other indicators to analyse why free cash flow is negative because the company is apparently highly solvent and there seems to be no issue with liquidity. Further investigation reveals that the company has recently carried out capital expenditures that are roughly equivalent to the free cash flow figure.

The figure above shows that the company has invested additional cash flow into capital expenditure and this is why the free cash flow figure has gone down drastically in the last quarter.

Also See: What Caused the Great Depression and Can We See Similarities Today?

Investor Guidance

As it is apparent now, Ecofibre is different from all the companies that we have discussed so far. Ecofibre has got over a decade of experience which means that this company is well beyond its initial survival stage. Ecofibre is in its early to mid growth stage, it has already expanded to USA and its product offering is also increasing and getting diverse. It is not only focusing on the medicinal cannabis sector but also trying to enter into hemp based fabric sector.

In addition to this, the fundamentals of Ecofibre are very strong, which shows that the financial structure of the company is well planned and stable and therefore any investment in the company will be a low risk investment. This however also means that at the moment Ecofibre is not a growth stock, as its share price is largely stable.

Like other companies in this sector, Ecofibre is also limited by the scope of the medicinal cannabis sector. No company can outgrow the sector it is situated in and the reality is that the medicinal cannabis sector is in its infancy, true growth in the companies in this sector cannot be seen till proper infrastructure and supply chain logistics are established. Till then, long term investors have got some time to create their strategies to invest in this sector for the long term.

Main Image Source: Pixabay

Also See: Top 10 CBD Products To Watch in 2021

Survival 101: The Top Ways to Survive in the Australian Outback