Everything You Need to Know About Province Resources Ltd

Province Resources (PR) is a natural resource exploration and development company. The company is listed on the ASX and is currently involved in the mining, exploration and further processing of minerals such as copper, gold, nickel, cobalt and other naturally occurring minerals in Australia.

At present, the company is positioning itself to take advantage of the innovations in the sustainable energy sector. The growth of the sustainable energy sector is happening at a rapid pace and according to market data, the funds allocated by G20 nations for fossil fuel-based energy resources are about 40% whereas the funds for renewable energy sources are around 36-38%.

This shows that the allocation of funds for renewable resources is now almost head to head with fossil fuels. What this means for companies like Province resources is that the demand for minerals used in the production of renewable energy is going to skyrocket. Which is going to increase the workload for mineral extraction and processing companies like Province Resources.

Province resources are very well positioned right now to take advantage of this growth. PR has recently come into a highlight for its plans to buy the HyEnergy Zero Carbon project in West Australia. This move into hydrogen-based energy production is all the rage in the sustainable energy sector right now. Hydrogen is being seen as the next gold for the natural resources sector. Hydrogen based energy production is completely clean, with water as its byproduct. The only downside, for now, is the high cost of production, which is expected to come down as more players enter the market and improve the process through research and development.

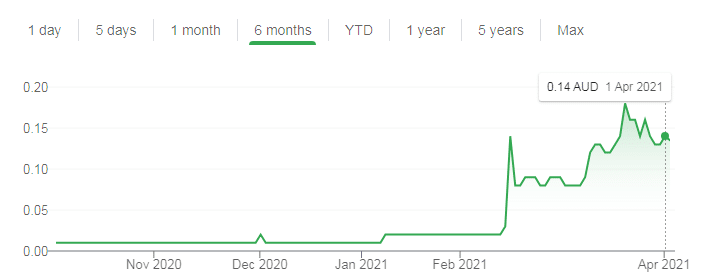

PR intends to set up solar and wind power plants, which will be used to generate hydrogen. Thus making it a completely green and sustainable process. This news started a bullish trend for PR shares

The operations of Provinces resources are based in Sweden and Australia.

Also See: How Australia Can Win the Trade War With China?

Projects in Australia

PR has got the following projects in Australia that are either in various stages of completion.

- HyEnergy Green Hydrogen: Potential Green Hydrogen Project.

- Gascoyne Projects Sa’t/SOP & Mineral Sands: Mineral extraction projects

- Pascalle Au-Cu: Mineral extraction projects

- Gnama Ni-Cu-Co: Mineral extraction projects

Projects in Sweden

PR has got the following projects in Sweden

- Skane Vanadium

Financials

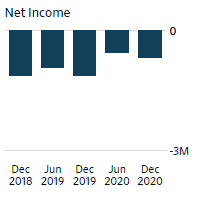

Bluntly speaking, The financial performance of PR is not that strong, instead, it is more on the weaker and dangerous side. Why? The company was incorporated in 1993 and this gives it almost 30 years of being in the industry. The company has also made some acquisitions in Australia in the last year but despite all of these years of experience and growth, it seems that the company does not have a strong financial base. Which should have been there in three decades.

This is the net income graph, it can be seen that at least since 2018, the company has had negative net income or losses. The total negative income or loss in 2020 was almost AUD 2 million.

This loss means that the company is also not able to pay any dividends to its shareholders, which means that the return on investment has been nil. This rules out investors looking to make a return through dividends of PR.

The investment ratios such as the return on assets are all negative. The return on Assets is negative 34.24. This means that if you invest in PR you are not going to get any return on your investment. The assets are not generating any income instead are making a loss. Now you may recall that in some of the other articles we have given a green light to companies having net loss and negative indicators.

Also See: Could Australia’s Dispute With China Cost Australian Jobs?

The difference is that those companies are new. For a company that is only five or six years old, it is normal to have negative figures but for a company that has been in the mining sector for almost three decades, having negative indicators is a major red flag.

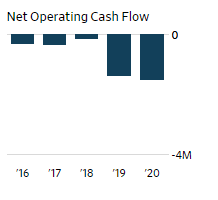

The graph shown above shows the net operating cash flow for PR. Net Operating Cashflow is one of the most important indicators when it comes to determining the strength of a company. Remember that it is common for a company to be at loss. Low profitability does not mean that a company is a bad investment, companies go in and out of good and bad profitability phases.

It is the liquidity that is most important for investors. A company incurring losses can be a good investment choice if it is liquid and has sufficient free cash flow. Free cash flow refers to the cash available for creditors and shareholders. Any company that has problems with its cash flow, is a bad investment choice because problems with cash flow indicate problems with the management and structural issues.

This shows that the company is not able to control its revenue, expenditure, receivables and payables. Investing in a company that cannot control its cash flow can be a bad choice, given the fact that the company in question has been operational for almost 30 years.

You may be wondering that despite this dismal financial performance, the share price of the company is currently going through a bullish phase. Why? That is because of a very unique set of circumstances that the company has put itself in.

Firstly as mentioned above, the company is aiming to benefit from the sustainable energy sector. This sector is getting a lot of attention, with investment flowing in from all sides. Private investors and public investors are both looking favourably at companies that are coming up with proposals for research and development in the sustainable energy sector.

Secondly, PR has recently announced to adopt of the Environment Social Governance (ESG) standards. These standards will put PR in an elite group of companies that focus on implementing systems and processes that focus on the environment and society.

The ESG status means that PR will now be in the sights of investors who prefer to invest in companies that have pledged to focus on sustainable production. This is one reason why PR is now shifting and aligning itself with the sustainable energy movement.

This means that PR will not only be able to get increased funding but it can also benefit from various subsidies and other benefits given by the governments to companies that actively adhere to ESG standards.

This is one reason why despite the weak financial performance, PR`s market value is not only going up but the company is also confident about opening up new projects. The future for PR looks promising for now but it will have to focus on controlling its finances. It can ride the tide of ESG for now but in the long run, PR will need a strong financial base.

Disclaimer

Australia Unwrapped provides only general, and not personalised financial advice, and in no way has taken your circumstances into account. Investments go up and down, any questions talk to a financial advisor. This blog is opinion only and in no way should investment decisions be based on this information.

Australia Unwrapped does not endorse or vouch for the accuracy or the authenticity of postings, comments or the article

Fun Fact

What happens when you share a stock?

So when you buy a stock on the stock market, you’re not buying it from the company, you’re buying it from another shareholder. When you sell your stock, you’re not selling it to the company, you’re selling it to another investor.

Also See: New Zealand Votes On Legalisation Of Cannabis Creating A New Industry