How To Gain Financial Independence Through Property Investment

Financial freedom is a dream that many people have in this world but achieving this dream seems to be becoming more and more difficult, particularly when you consider the impact of the Covid-19 pandemic.

The pandemic has literally thrown a wrench to the global economy. Poverty is on the rise as millions across the globe have either lost their jobs or are on the verge of losing it. Such difficult times call for some robust financial planning.

Property Investment

Investing your money into property can be a good way of future-proofing your finances. You can invest in a rental property which will give you continuous rental income and thus allow you to create a passive income stream for yourself.

One thing should be kept in mind, never put all of your eggs into one basket. If you have got an investment portfolio then make sure that you divide up and diversify your investments. You don’t want to invest all of your savings in the property market and then end up getting into a major loss.

Basics of Property Investment

As with any other mode of investment, it is important to study the market that you are aiming to invest into.The property market is a very different market, so it is very important to understand the market first.

Firstly it is important to know that prior to the breakout of the pandemic, the global property market had an upward trend. Prices were rising and thus it was a very profitable sector. The breakout of the pandemic however caused the global property market to crash because the investors went into money saving mode, due to the uncertainty created by the pandemic.

Also See: How To Invest 10000 Dollars In 2021 In The ASX

Property sector in Australia

Australia had a similar trend, the breakout of the pandemic caused the property prices to fall.

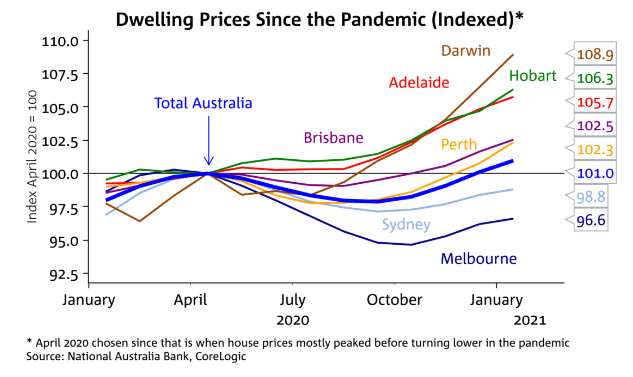

The graph below taken from Property Update shows how the property sector in Australia has fared since the pandemic broke out.

As the year 2020 started, the prices were on an upward trajectory but then they levelled out around April when the pandemic was declared and then till October the prices saw a downward trend. However the lockdown in Australia at the end of the last year, helped minimise the infections and this restored confidence among the investors.

In addition the super payments and increased savings of the investors also had an impact at the end of 2020 and we can see that the property prices are once again on the up. Now from this graph, the best time to invest in property in Australia was around October 2020, because that was when the prices were at their lowest.

As compared to October the price index has gone by marginally by 1-2%, so it is still a good time to invest into the property market if you have got the savings. The uncertainty however must be kept in mind. The infections are increasing globally so, if there is another prolonged lockdown, the prices may fall again.

This however, is still a speculation. It is probably not likely to happen because the vaccines are being rolled out. So the most likely scenario is that from this point onwards, the prices are going to rise unless something out of the ordinary happens.

This graph shows the median house value. In other words this graph shows the mean reversion of the housing market. In very simple words, what this means is that in the long term, the recessions do not matter. In the long term, prices will always increase and end up giving you a profit. So if you are a long term investor, then your property investment will end up giving you a profit in the long term, you will just have to be patient through the recessions.

Also See: Actual Possibility That the Human Race Will End: The 6th Extinction

Scope out Good Areas

One very important thing to consider when investing into property is to scope out areas that are good for investment. Now this will also depend on your budget. So firstly, take account of how much you can spend and then use local listing sites and realtors to scope out areas that have high demand both for sale/purchase of property and for rental purposes as well.

Why? Because high demand for sale/purchase means that if the value of your property appreciates, you can easily find buyers to sell your property and realize your gains. High demand for rental purposes means that firstly you will get a good rent, secondly your property will remain occupied. Even if tenants leave, you can always find new tenants.

This is why it is very important to scope out good areas. Every city has got certain areas that are good for investment. Usually areas that are close to malls and offices have a good value.

Determine Your Purpose

Another very important thing to do is to determine why you want to invest in property. We have covered this in detail in our of the earlier blogs. Basically you can invest into property for

- Earning rental income

- Renovating properties and selling them for a profit

- Buying, holding and selling for a profit

- Investing into REITs

Each of these purposes will require a detailed plan. You can refer to the earlier article for details. Right now we are going to assume that you want to invest to earn rental income. In such a situation you should also have risk management strategies in place.

Risk Management

Risk management for rental property investment requires taking out insurance so that you are covered against any losses. You should also vet the tenants, so that you know who your tenants are. This should however also be required by law.

Exit Strategy

Every investment strategy requires an exit plan. You are not going to invest your savings indefinitely. When business angels or VCs invest in any business they chalk out their exist strategy first.

So when you are going to invest into property, make sure that you have your exit strategy in mind. If you are going to invest into a rental property, then how long will you keep your money invested? Do you want to pass it down to your children or are you looking to sell the property if you get a good rate? In such a case, you will need to focus on keeping your property maintained so that buyers can find it appealing.

To conclude this, it must be said again that remember to diversify your investments. If you are investing in property then also spend some of your savings into stocks and other investment assets, to balance out the risk. Real estate is not generally a very risky investment, so this can act as a good risk stabiliser if your other investment assets are quite risky.

Australia Unwrapped provides only general and not personalised financial advice and in no way has taken your circumstances into account. Investments go up and down; any questions, talk to a financial advisor. This blog is opinion only, and in no way should investment decisions be based on this information.

Australia Unwrapped does not endorse or vouch for the accuracy or authenticity of postings, comments or the article.

Also See: 5 Signs a Company May Be Heading Towards Bankruptcy