Things You Should Know Before Investing in Althea Group Holdings Ltd

Althea group holdings is a private sector holding company that was founded in 2014. The group has got subsidiaries that operate in the health care sector in Australia. Althea Group is one of the leading providers of solutions based on innovative technology to help healthcare provision. Althea is not just present in Australia but it has an almost global presence with “Centres of excellence” in regions such as

- Europe

- UK

- Ireland

- USA

- India

Althea group can be seen as an outsourcing technical partner company for businesses in Australia. They can provide innovative technological solutions ranging from biomedical equipment to equipment used in radiology and imaging.

Althea has over 30 years of experience in the healthcare industry. This experience gives them edge over their competitors and full knowledge of healthcare processes. Althea is focused on maintaining competitive edge through constant innovation in technology.

Also See: 10 Things That You Should Do When Writing Your Will

Focus on Customer service

With a constant focus on customer satisfaction, Althea has managed to create a portfolio of services that give their clients a single point of reference for all of their relevant healthcare needs. The equipment and solutions provided by Althea are modular, which means that they can be easily repaired or maintained when needed.

It is important to understand that the products and services provided by Althea are very critical for their clients. Most of the time, if not all the time, the lives of hundreds and thousands of patients depend on these equipments. The pandemic has shown us just how critical these equipments are for sustaining patients who are critically ill. For this reason Althea makes sure that their equipments have minimum downtime and fast repair and maintenance, even in unexpected and critical situations.

Mission Statement

The mission statement as stated on the official site of Althea group is as follows

Althea is committed to helping hospitals improve outcomes, enhance care and deliver better quality of life for patients, through our comprehensive services and our deep understanding of processes.

As it can be seen from their mission statement, Althea is basically focused on providing technological solutions to the healthcare sector. This puts Althea in an environment that is volatile on account of the rate of innovation that is happening in the industry.

Products and Services

Althea group provides the function of managing and maintaining medical technology in hospitals and at home. Althea group has a large number of vendors providing various health care products and services. The clients get to benefit from this large number of vendors through Althea group. Instead of approaching these vendors separately and then negotiating contracts with them, which is a time and resource consuming task. Clients can simply approach Althea and thus get access to top of the line health care equipment, while the group manages the backend of the operations. As mentioned above, clients also get the equipment management and maintenance sorted out through Althea. This allows hospitals in particular to focus exclusively on patients.

Althea provides the following products and services

- Biomedical services

- Biomedical technology management

- Endoscopy and ultrasound probes

- Surgical instrumentation solutions

- Diagnostic imaging services

- Diagnostic imaging services

- RIS-PACS services

- Spare parts

- Outsourcing services

- Integrated services

- Public private partnership opportunity

- Managed equipment services

- Home care solutions

- Turnkey projects

Also See: Why Stoicism Promotes Living According to Nature

Financial Summary

1. Profitability

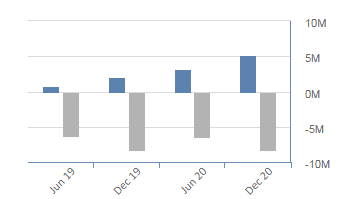

Althea has been struggling in terms of its finances. While the revenue collection has improved, the net loss for the company has not shown a lot of signs of improvement. For the half year ended 31st December 2020, Althea group posted AUD 5 million as their revenue collection. Whereas the net loss incurred by the company was AUD 8.3 million.

The blue bars represent revenue collection whereas the grey bars represent net loss. It can be clearly seen that although the revenue collection has increased, the rate at which it has grown is not enough to over come the net loss that the group is incurring. Closer analysis of the financials reveals that the expenditures of the group are the main contributor towards the net loss figure.

The gross profit margin is around 55.7% whereas the operating margin is negative 173.9% and the net profit/loss margin is negative 175.86%. This once again shows that the expenses of the group are the major contributor towards the net loss.

This net loss also means that the return on investment for the group is negative 27.72. Net loss also means that the group cannot pay dividends to its shareholders, as long as the loss persists. Given the fact that the revenue is around AUD 5 million whereas the net loss is around AUD 8 million, it seems highly unlikely that the company can turn this loss into profits and thus pay dividends.

2. Liquidity

The liquidity situation of Althea group is better as compared to its profitability. The quick ratio or the acid test ratio which represents the ratio of liquid reserves and the current liabilities stands at 2.47 which is a safe figure. This shows that for every $1 of current liability, the group has got $2.41 of liquid reserves.

The current ratio which is simply acid test including the inventory stands at 3.53, which once again is a good figure.

Also See: 10 Entrepreneurs Who Made Their Fortunes After Turning 30

3. Leverage

The leverage situation of the group is also very good. The long term debt to equity is 5.4% whereas the total debt to equity ratio is 5.78%. Low leverage means that the group is financed mostly by the shareholders. It is common for companies to have a high leverage, to take as much advantage as possible from the tax effect of interest payments.

Althea group is in a very important sector and it is providing services that are of the vital need for the Australian population. It can also be said that the Althea group is playing a key role in making sure that the Australian people get access to the latest technology in terms of health care. The financial position of the group is mediocre at best. It is not doing too good in terms of profit but the liquidity is good enough to put it out of any immediate danger. There is however definitely room for the executive board to take some critical decisions to ensure that they are using all possible options to minimise the expenditures, to cut down and eliminate the huge loss that has mounted up.

Disclaimer

Australia Unwrapped provides only general, and not personalised financial advice, and in no way has taken your personal circumstances into account. Investments go up and down, any questions talk to a financial advisor. This blog is opinion only and in no way should investment decisions be based on this information.

Australia Unwrapped does not endorse or vouch for the accuracy or the authenticity of postings, comments or the article

Main Image Source : Pixabay

Also See: How to Have a Healthy Mindset with Geo – Day 28

Australian Manufacturing How We can Bring Jobs Back Down Under