All You Need to Know About Creso Pharma Ltd (ASX_ CPH)

Creso Pharma is an Australian company situated in the pharmaceutical and biotech sector. Creso pharma got listed on the ASX in 2016 and thus has had almost five years of experience in the industry. It operates in the niche of cannabis, bringing together technical and methodological expertise to create innovative hemp-based products for the community. Creso pharma aims to differentiate from its competitors by focusing on technological advantage through cutting edge research and development.

Creso pharma started out as an Australian company but it has soon branched its operations out globally to Canada,Switzerland and Columbia.

Mission Statement

The mission statement of Creso pharma is as follows.

“Cannabis innovation in the science of life for people and pets.”

They have clearly stated in their vision that they believe in technology to develop innovative hemp based commercialized products for both humans and animals. Their aim is to become “the world`s most trusted supplier of cannabis and hemp derived products”.

This is the strategy that they have stated out on their site.

- Use pure cannabis and hemp as ingredients

- Use the pharmaceutical and cannabis expertise to research into new products

- Use the technological edge to create innovative products and delivery mechanisms, thus creating competitive edge

- Seek regulatory approval for commercial sale

- Build strategic partnerships

The broader strategy is to follow the five strategic points mentioned above to look for global partnerships. Creso Pharma is open to collaborating with other producers to create cannabis-based products either under the Creso brand or with a partner branded with Creso Trustmark.

Also See: How to Stay Fit and Healthy at Home with Geo – Day 26

Products

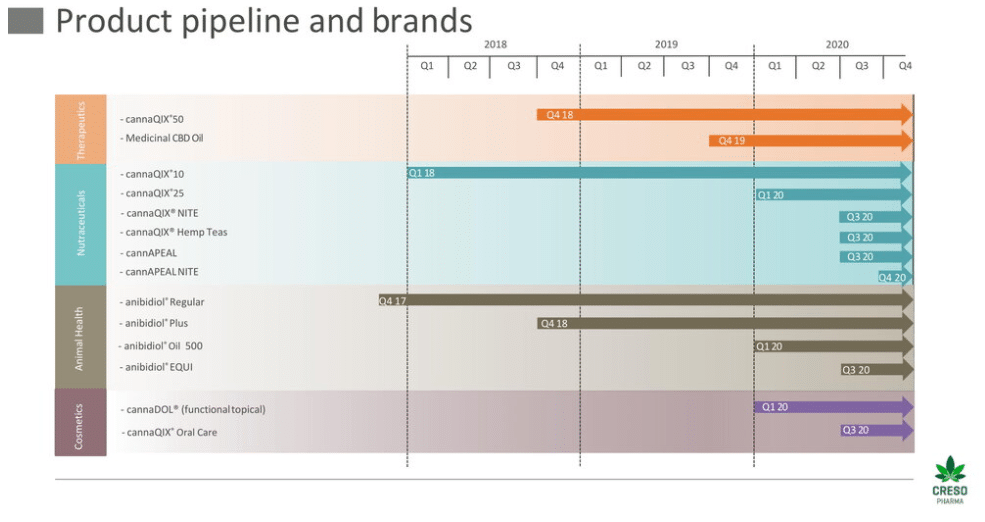

Creso Pharma has got the following product lines

- Therapeutics

- Shop lozacan. Available in Australia.

- Cannaqix 50. Available in New Zealand.

- CBD oil medleaf. Available in New Zealand.

- Nutraceuticals

- Cannaqix

- Cannaqix hemp teas

- Animal health

- Anibidol

- Anibidol Equi

- Cosmetics

- Cannadol – Coming soon

- Cannaqix oral care.

News and Events

Creso pharma has been in the news lately. The company plans to acquire a Canadian psychedelic treatment company named Halucenex life. If the acquisition goes ahead, it will position Creso pharma as the first ever company listed on the ASX to enter into the Canadian psychedelic market.

The market was buzzing with these rumors when Creso pharma decided to go for round of share issue, which allowed the company to raise $18 million in financing. John Hancock is among the prominent investors who funded this round of financing. Following this round of financing, the shares of Creso Pharma experienced a 26% rise in share value, which shows that the market is seeing this development positively.

In addition to this news, the company is also planning to apply for a dual listing on the US OTCQB exchange. The decision to go for a dual listing in the USA will allow Creso to expand into American markets and thus be able to raise more finance and get more exposure.

Available information also shows that Creso pharma has got purchase orders of up to $1 million, that are set for delivery in the first half of 2021. This shows that there is considerable growth in revenue.

Financial Performance

The graph above shows the stock performance of Creso pharma. It can be seen that the stock price went up in December and has since then, more or less stayed the same. This recent performance can be attributed to the news about possible acquisition and expansion into North American markets.

As stated above, Creso pharma has got purchase orders of up to $1 million for the first half of 2021 already. While this shows that the revenue stream is good, the net income shows a different picture. The last few years have seen consistent net loss for the company.

The gross profit margin in negative 54%, whereas the net margin is negative 1248%. This shows that the company is incurring a lot of expenditure, most of which is on research, development and expansion of operations. Almost every financial indicator is negative, which for the investors looking for a return, is not a very good sign.

Also See: The Long Road to Recovery Make Today Count – Day 9

This performance however is typical for companies in the cannabis niche of the pharma and biotech sector. This sector is still a very young sector and thus needs a lot of investment into research and development of new products. Since this is also a very technologically intensive sector, the costs of operation naturally go very high. These costs cannot be curtailed as doing so would take the competitive edge away from the company.

There are however clear signs of concern when we look at liquidity. Remember that if a company is not making a loss, it does not necessarily mean that the company is about to go bankrupt. A company can carry the loss over many periods. What really indicates upcoming financial troubles is falling liquidity.

Thus while many other companies in this sector have low profitability, they usually have good liquidity to keep them afloat. Creso pharma however seems to be going over very thin ice in terms of liquidity.

The interest cover is negative 1.11. Which simply means that the company does not have enough profit to pay the interest on its debt. The current ratio is 1.45, which means that the current assets are just enough to cover the current or short term liabilities. The quick ratio which is like an acid test ratio for liquidity is at 1.22 which is dangerously close to the company being seen as insolvent by its creditors. Such a low quick ratio is a red flag and must be an alarm bell for the creditors of the company.

What this means is that although Creso pharma has got high ambitions to acquire other companies and expand globally, its financials are not very encouraging at the moment. Now once again, although not typical but for a company that is both young and in a sector that is very young as well, it is not out of the ordinary to see such a financial position. For the investors though, this means that there is going to be very high risk associated with Creso stocks. There is no dividend payout because the company is in a loss, so investors looking to earn through dividends have nothing to go for.

Other investors looking to generate some income through speculation may however find some profit if they have got the right strategy. Apart from this, if there are any gains to be made by investing in Creso stocks, they are only long term gains.

Disclaimer

Australia Unwrapped provides only general, and not personalised financial advice, and in no way has taken your personal circumstances into account. Investments go up and down, any questions talk to a financial advisor. This blog is opinion only and in no way should investment decisions be based on this information.

Australia Unwrapped does not endorse or vouch for the accuracy or the authenticity of postings, comments or the article

Main Image Source: Pixabay

Also See: Is Cann Global Ltd (ASX_ CGB) Probably a Good Investment Or Not?