Invest In These Top 5 Cannabis Stocks For A Greater Profit

The last few years have seen a paradigm shift in respect to the usage of cannabis. Cannabis based medicinal and health products have turned into a heavily funded sector of the economy. Be it USA, Canada, Australia or any other country that has recently legalised the usage of medicinal cannabis, the growth in the medicinal cannabis sector has simply been mind blowing.

The medicinal cannabis sector has become a sector with great growth potential because the research into the medicinal properties of cannabis and similar plants is just beginning. This simply means that this sector has got immense growth potential, so let us look at the top ten cannabis stocks in the Australian stock market.

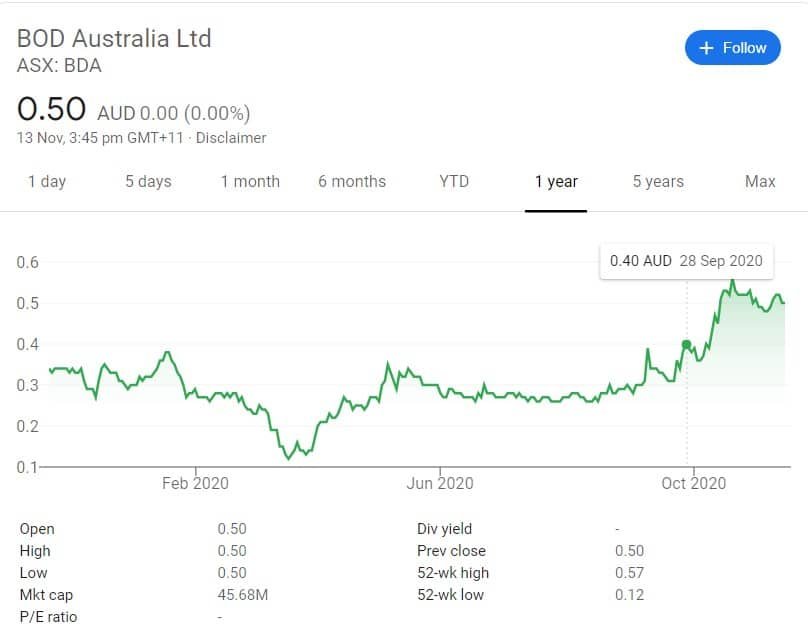

1. BOD Australia (ASX:BDA)

BOD Australia has a market capitalization of almost AUD 17 million and it is a CBD and hemp healthcare company. The company is focused on innovation, using research and development into medicinal cannabis to try and create products that make life easier for the people. They claim to be building a suite of products for the healthcare industry in Australia but the company also aims to enter into the European market and the UK.

BOD Australia sells prescription and OTC products in over 1000 outlets in Australia, these outlets consist of healthcare stores, pharmacies and retail stores.

The chart above shows the movement in share price of BOD, at present the price is around $0.36 per share. The last six months of price movements show a positive trend where the price has largely remained stable and at times shown upward trends. Must be kept in mind that this is remarkable performance during the covid pandemic.

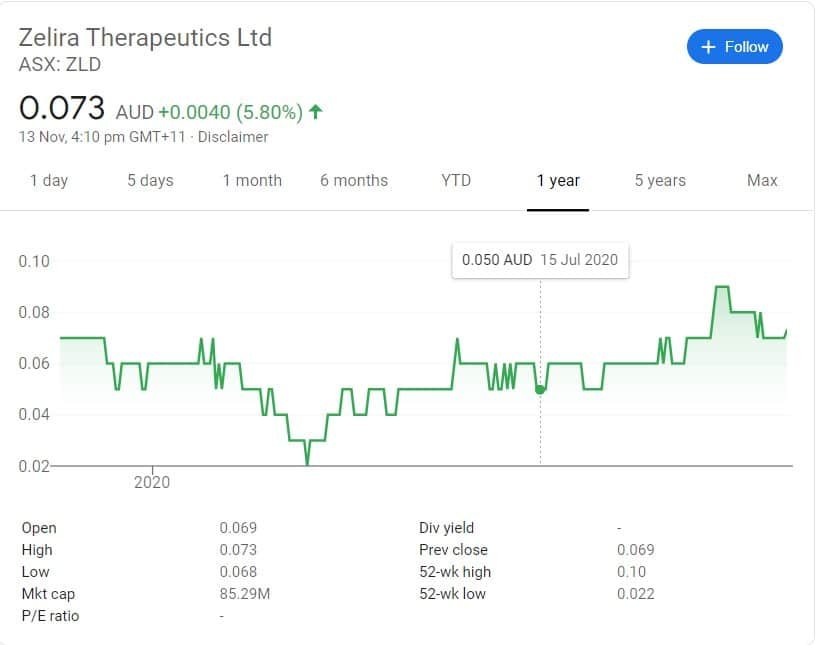

2. Zelira Therapeutics (ASX:ZLD)

Zalira therapeutics, formerly known as Zelda therapeutics is one of the leading therapeutic cannabis manufacturers and distributing companies in the world. Zaleria has got a portfolio of multiple income generating products, some of which have been introduced in 2020, while others are in their late development stage. Zelira has launched products in the US as well as Australia. It also has a strategic partnership with European medicinal cannabis group HAPA, this partnership allows Zelira access to HAPA`s state of the art manufacturing facilities.

The company has got a market capitalisation of roughly AUD 32 million, which makes Zelira a small capitalisation company. The share price is very low but the past trend of share price movement shows healthy movement. Zelira can be roughly classified as a growth stock, because at present its share price and capitalisation are low but as the medicinal cannabis sector develops and more products come into the market, we can expect Zelira`s share price to shoot up.

Also See: Top 10 CBD Products To Watch in 2021

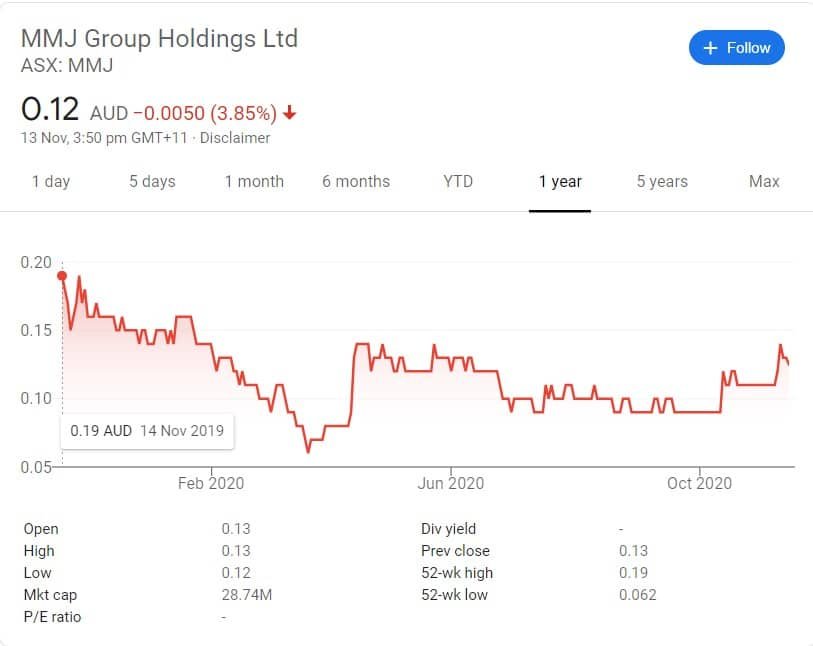

3. MMJ Group Holdings (ASX:MMJ)

MMJ Group Holdings was listed in the ASX in 2015, its current share price is around AUD 0.105. The company has a diverse range of investments in the cannabis sector. These investments include products for health care, tech sector, infrastructure, cultivation, research and development and retail. It would be better to say that MMJ group is looking for complete upward and downwards integration into the medicinal cannabis sector, where they intend to control the whole supply chain from the cultivation of cannabis to its sale in stores.

At present MMJ group has got a market capitalisation of around AUD 53 million and the best bit for investors is that the return on investment as stated in the published financial statements of the company, is almost 20%, which is a very high rate of return.

4. Creso Pharma (ASX:CPH)

Creso Pharma has a market capitalisation of roughly AUD 57 million and share price of almost AUD 0.03 per share. Creso pharma was the first company in Australia to import medicinal cannabis. Creso pharma also has the badge of being the first ever company to launch medicinal cannabis products in Switzerland for both animals and human beings.

Creso pharma launched anibidiol which is a hemp based oil feed for animals and they also launched cannaQIX which is a hemp based oil nutraceutical for human use . Creso pharma has expanded into Canada after acquiring Mernova, a canada based cannabis growing company. This acquisition gives Creso Pharma better access and control over the supply of cannabis for research, development and production purposes.

The price movement chart shown above does not show a very good picture for Creso pharma shares. The company has seen 57% increase in revenue, which is a good sign. The net tangible assets per security, which simply shows the value of assets backing each share has also increased from 0.12 to 0.16 which is a good indicator. The EPS or rather loss per share figure however has fallen from 9.31 to 7.97 and the main factor for this has been the loss incurred by the company for the year ended 30 June 2020.

Although this may sound a bit weak but it must be understood that companies in the medicinal cannabis sector are very young and the whole industry is young, therefore we cannot expect these companies to show performance like that of Amazon or Facebook. With these companies, the investors need to have a risk seeking attitude because the real return from these companies will start to come after 3-5 years.

Also See: THC -CBD Medicinal Cannabis Could Help Australia Financially

5. THC Global Group (ASX:THC)

The THC global group was founded in 2016 and in 4 years the company has established a strong footing in the global medicinal cannabis sector. As of yet, the company is operational in both Australia and Canada. THC global got listed on the ASX in 2017 and therefore has had roughly over 3 years of operating as a listed entity.

Since 2017, the company has acquired medicinal cannabis research licenses and the first product of the company was made available for the Australian patients in mid 2018. At present the company has got a market share of around AUD 60 million with its share price at approximately AUD 0.24. The revenues from operations have increased by almost 60%, which shows that the company is capturing market share. Profitability has fallen by 3% which is not much of a concern, given the fact that the company is hardly 4 years old and still in its early stage. Net tangible assets per security have decreased from 0.14 to 0.13

Investor Guidance

There are more Cannabis stocks listed in the ASX but the aforementioned 5 companies are the upcoming stocks that interested investors should watch out for. The caveat for the medicinal cannabis sector, that has been mentioned above needs to be remembered.

Investors need to understand that this is a very young sector and therefore the companies in this sector are young and most of their funds are right now being injected into product research and development. This is a highly specialised sector and therefore investors should expect profitability in almost 3-5 years time. In about 5 years time, when the industry is established, there will be a boom and the share prices should then start to rise, so if you buy low now, your strategy should be to hold the investment for the long term.

Main Image Source: Pixabay

Also See: Why Many People Use Cannabidiol To Relieve Pain?

Australia to Benefit From Legalisation of Cannabis Through Tax Revenue