Watch These 5 Potential ASX Companies That Will be a Game Changer in 2021

The year 2020 has been very turbulent for businesses and it is expected that with the rollout of the vaccines, much of this volatility and uncertainty is going to reduce, thereby allowing startups and upcoming companies to claim their space in a more conducive environment.

In this article, we are going to look at 5 upcoming companies in the ASX that are worth watching. This does not necessarily mean that these companies are going to make it big but they may just do it. Our analysis is going to be based on publicly available data and opinions of market experts.

1. Aristocrat Leisure

Aristocrat leisure is based in the tech sector, it is a company that focuses on the gaming industry. First of all, the gaming industry is a very hot industry at the moment. With the launch of PS5 and other gaming consoles, in addition to the games already available on other devices, the gaming industry is not going anywhere anytime soon.

2020 has been lukewarm at best for Aristocrat Leisure (ALL), the share price graph below shows how the share price for ALL has behaved throughout 2020. ALL started 2020 on a high note and it reached its all time high price of AUD 38.32 in February-March before the markets crashed in March.

Although the market crash dealt a heavy blow to ALL`s stock price, it recovered steadily throughout the year and is currently trading close to AUD 30, which was its high point before the markets crashed.

ALL has a market capitalisation of AUD 19.6 billion, which is quite impressive for a young company. In addition to this the P/E ratio is something investors will be interested in. The share price is around AUD 30 but the P/E ratio is 75 which shows that the market has overvalued ALL`s share price.

This simply means that the shares of ALL are trading far more than they are worth. This is not bad, this means that the market has got great expectations from ALL in the future, which is why the market is showing trust.

Read More: Will The Economy in Australia Bounce Back in 2021?

2. Alcidion Group Ltd

The Alcidion group is situated in the bio tech sector, which puts it in a well positioned sector to take off in 2021. Experts are of the opinion that Alcidion group can worth watching closely in 2021. The company got its IPO as a reverse takeover in 2016, which makes it a small cap company as of now. Even though it is a small cap company, it is already overtaking the competitors in the bio tech sector.

The share price graph for Alcidion Group (ALC) shows that the company has had a optimum year to say the best.

Although the share price reached its high of AUD 0.24 in February – March but it crashed when the global markets crashed and has since then recovered. The last major spike in share prices occurred in October-November, spurred by the news of the vaccine roll out. At present the share price has recovered significantly.

ALC focuses on providing software solutions that can improve the administration of services to patients. 2021, is therefore going to be a very important year for the company, if they can grab the opportunities that are going to come their way, with global focus shifting towards healthcare even more now.

The 2 companies we have discussed are already present in the market. Let us now look at some of the upcoming IPOs that are expected to break out in the ASX in 2021. The three companies discussed below have been ranked in terms of the market capitalisation, the data for which has been taken from Listcorp.com.

3. Nuix Limited

Nuix is based in the tech sector, it is a company that specialises in creating innovative data analytics software for organizations. The Nuix software can be used to bring forth meaning from data collected by organizations. With data being king, data analytics have assumed a central position of importance in business organizations. Which is why it is expected once the shares of Nuix are floated in the market, they are going to perform quite well.

The share price for Nuix is expected to be between AUD 8 and 9, with the market capitalisation being around 2.6 billion.

Read More: 5 Best Websites to Learn About Investing in The ASX in 2021

4. Deterra Limited

Deterra Limited is situated in the mining sector and holds royalties over iron ore produced in specific areas of Western Australia. Royalty companies like Deterra provide the exposure to the value of discovery, extraction and sale of natural resources such as iron ore, without getting exposed to the operational risks of investing into the mining companies.

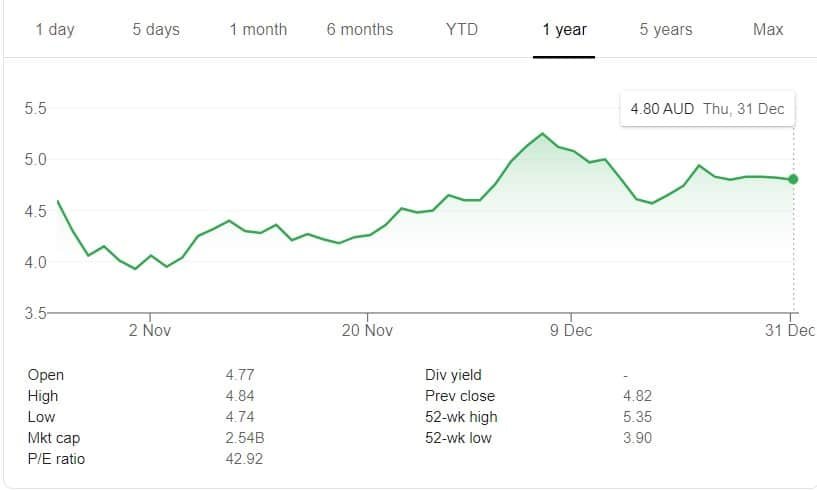

The share price of Deterra is expected to be around AUD 4.5 and 5, with expected market capitalisation of 2.5 billion, once it is floated into the ASX.

5. Magellan Global Fund

The Magellan global fund is an investment fund that aims to invest the funds into profitable companies. Magellan aims to invest in companies that are particularly good at exploiting their competitive advantage, thereby earning profits in excess to their costs.

The share price of Megallan fund is expected to be between AUD 1.6 and 1.8, with expected market capitalisation being around 2.17 billion.

So, in this article we have covered 2 existing and 3 upcoming companies that the investors should keep their eyes on in 2021. While it is easier to predict about the performance of companies already in the market, it is not so easy to do the same for the upcoming IPOs, therefore investor due diligence is required. Don’t simply take our word because a single article is not enough to analyse every company from every possible angle. Make sure to carry out your own due diligence before investing, in order to reduce the risk of loss.

Main Image Source: Pixabay

Australia Unwrapped provides only general and not personalised financial advice and in no way has taken your circumstances into account. Investments go up and down; any questions, talk to a financial advisor. This blog is opinion only, and in no way should investment decisions be based on this information.

Australia Unwrapped does not endorse or vouch for the accuracy or authenticity of postings, comments or the article.

Also See: Best Apps or Websites to Buy Shares in The ASX in 2021

What a Diverse Portfolio! How Many Companies Should I Buy Into?