Australian House Prices Forced Up By Overseas Buyers?

The Covid-19 pandemic has wrecked on both public health and global economy and when you talk about global economy then the real estate is one of those sectors that have been badly hit by the pandemic globally. The Australian real estate market has been hit in a similar manner although the effect has been les profound in Australia as compared to USA.

Trends in the Australian Housing Market

In order to understand what has been happening in the Australian housing market recently we need to understand the long term trend.

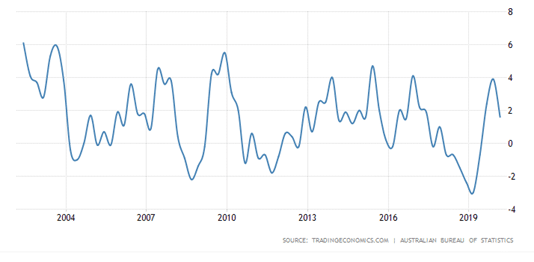

The figure 1 shown above shows the housing price index in Australia over the last two decades. Now since this is an index, this doesn`t show us absolute values but this does show us how the prices have fluctuated. The trend shows us that the Australian housing prices goes through a rise in housing prices roughly after every 3 years. This means that after every 3 years the Australian housing prices rise due to a rise in demand.

This is what we need to understand that the housing prices are fundamentally linked with the supply and demand. The prices in any economy are set by the free market mechanism and when there is a high demand, then this high demand causes the supply to reduce and this causes the prices to rise.

There has been a long held assumption in Australia that the housing prices are driven up because of foreign buyers. Although this assumption cannot be substantiated by any data because there is a lack of detailed relevant data but we can attempt to look at this assumption to see how true this is. In 2014 an inquiry was carried out by the government to look at the reasons for the rise in prices in the Australian housing market and the inquiry couldn`t find any substantive evidence to show that the rise in price was because of an increase interest shown by overseas buyers. However the report was able to declare that one reason for an increase in price was the shortage of supply.

However since this report is over six years old, it can no longer be considered relevant under current conditions but we can see that around 2014 the housing price index rose consecutively for almost three years.

Read More : 7 Passive Income Ideas You Need to Know

The Make up of the Australian housing market

The Australian housing market can be divided into two groups.teh first group comprises of local buyers and the second group comprises of foreign buyers.

It has been observed that both of these groups have different buying needs and habits. The local buyers seem to have a preference for houses under the $1 million category whereas overseas buyers usually show a preference for much higher categories. Similarly most of the local buyers come under the first time buyers category and therefore they look for homes that are for small families and adjusted for their earning capacity and their mortgages.

Compared to them the overseas buyers come under the category of foreign investors and they are usually interested in properties that are bigger and higher priced. The investment in real estate by overseas buyers comes under the jurisdiction of FIRB and the FIRB website states that

Read More : APRA New rules; The Implications For Banks And Real Estate Investors

“The Government’s policy is to channel foreign investment into new dwellings as this creates additional jobs in the construction industry and helps support economic growth. It can also increase government revenues, in the form of stamp duties and other taxes, and from the overall higher economic growth that flows from additional investment.”

The overseas buyer are therefore classed separately as investors and they are actually encouraged by the government to invest into real estate for the construction of new buildings in order to boost economic activity. According to FIRB rules, foreign buyers can invest in

- New buildings: If a building or property has been newly constructed then there is no restriction upon foreign buyers to invest into it.

- Vacant land: Foreign buyers cannot buy and hold vacant land and plots, they need to construct a building over it within 4 years under law.

- Buying a home: Temporary residents are allowed to buy a residential property to live in but they are required by law to sale if off before leaving Australia.

Foreign buyers are therefore subject to regulation and the way FIRB has set up these regulations, purchases of real estate by foreign buyers are designed to increase economic activity and boost the construction sector.

From here it would therefore not be correct to state that overseas buyers are the primary reason for the rise in property value because overseas buyers are actually adding more supply to the housing market by constructing new housing units.

Why is the property value rising?

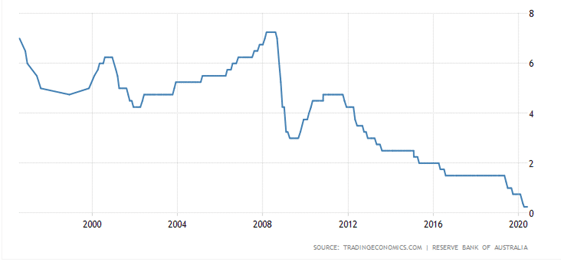

The rise in the property value can be attributed to several economic and non economic factors. First the cut in interest rates has been the main driver for increase in aggregate demand in the market. Whenever interest rates are reduced, this causes an increases in spending by the people because people are incentivized to invest.

Real estate, across the world is one of the go to sectors for investment. People either invest in equity through the stock market or invest in real estate to store their wealth.

This graph shows how the interest rate in Australia has fallen over the last decade since the financial crash of 2008. It is this cut in interest rate that has in particular driven the property value up. You can see that a major decline can be seen in 2012 that continues till 2014, roughly. Compare it with figure 1 shown earlier and you can see that this interest rate cut coincides with the rise in housing price index around 2014.

This shows that as the housing prices were cut, people elected to invest their savings into the housing market and this increased the demand for real estate and drove its prices up wards.

A similar interest rate cut can be seen around 2018-2019 and once again figure 1 shows that this cut corresponds with the rise in property values in 2019.

Also See : Top 10 Blue Chip Shares To Buy In Australia In 2020

Secondly, the demand in Australian housing market is increasing because the millennial generation is now adding to the demand for houses. First time millennial house buyers are entering the market, that was already seeing a shortage of supply and this is causing the housing market to go up through a boom like phase. Experts are actually divided whether this is a proper boom or an economic bubble.

The Covid 19 effect

The pandemic has caused a slump in the market and values have dropped by as much as 30% in some areas. While the slump in urban centres like Sydney is not as pronounced, it is more apparent in other areas of the country. The covid-19 has caused wide spread unemployment and reduction in purchasing power and this has caused Australians and overseas buyers to stop their expenditures. This has caused a reduction in demand and this phenomenon is globally driving the real estate sector into a slump. At present it would be difficult to predict when conditions will change because the pandemic is still developing.

Conclusion

It can therefore be concluded that overseas buyers are probably not the main reason for driving property prices up however they can be considered as one factor. There are other factors as well such as shortage of supply and most importantly the reduction in interest rates that has caused many Australians to spend their savings and most of the savings have gone into the real estate sector causing an increase in demand and therefore increase in real estate value.

Main Image Source : Pexels