Covid-19 and Influences On The Australian Economy

The Covid-19 pandemic is still a developing situation. We are halfway through May, and the world is still under the grip of the pandemic. Global death toll has crossed 310,000 at the time of writing this and there is no hope in the short term at least.

The preparation of a vaccine is still at least 18 months away and till then our only hope is to follow the precautions that are being given out and hope that we don’t get infected. As experts predict deadly second and third waves later this year, economists are pressurising the governments to end or at least ease the lockdown, otherwise, the financial crisis that is brewing will create a global financial contagion.

It is a catch-22 situation where you have to continue the lockdowns in order to save the people, with no cure the only way to prevent the spread of the virus is to break the infection chain and that cannot happen without lockdowns. On the other hand prolonged lockdowns are impossible to sustain and economists fear the worst if aggregate demand and the credit cycles collapse triggering a global financial crisis worse than the Great Depression.

With no cure in sight, it is likely that many countries will opt to ease the lockdowns. This won’t mean that the pandemic has ended, it will continue to have its toll both on the economy and on health. Institutions like the IMF are predicting a severe economic crisis worse than the Great Depression. IMF has reiterated this twice now, which only goes on to show that the economic threat is present.

1. Impact on Australia

The impact on the Australian economy has been quite damaging. According to a report compiled by PWC Australian GDP is set to contract by 1.32% in 2020 whereas global GDP declined by 5.2%. From these stats, it may look like Australia didn’t get hit badly, but this isn’t true.

The Australian economy is quite well balanced in the sense that its three sectors namely

- Primary

- Secondary

- Services

Sectors are well diversified and share the almost similar burden. Now the global economic disruption due to Covid-19 has impacted the manufacturing and the services sector the most. The primary sector has been the least affected whereas the manufacturing and services sectors have been the most affected because these sectors have the bulk of supply chains and human movement.

Manufacturing sector began declining in February when production in China dropped down to almost 30% and the services sector declined when the lockdowns came into effect.

Due to the fact that the Australian economy is deeply connected with the Chinese economy, the effects on the Australian economy began to manifest when China began to go into lockdown in early February. Tourism and education sectors were one of the first sectors to hit as a student and non-student tourism to and from China took a hit due to the lockdown. This was followed by a decline in the just in time discretionary expenditure businesses that export goods and services to China for example lobsters and Australian beef industry.

Lockdown impacted supply chains and as inventory levels declined fast, the effect was seen in the commodities market. Commodity prices in Australia rose in anticipation of stimulus and relief packages. This was followed by a depreciation of the Australian dollar. According to the report by PWC the Australian dollar is seen as a proxy of the Chinese Yuan and as the Chinese Yuan fell so did the Australian dollar to levels not seen previously.

The figure shown above shows the movement of the Australian dollar with the rise in coronavirus cases. It can be clearly seen that the Australian dollar was at its strongest in early January when the news of a novel virus had not yet surfaced. As soon as this news surfaced the Australian dollar, which acts as a proxy for the Chinese Yuan due to trade dependence, began to decline.

The graph shows three drop points for the AUD. Firstly, the AUD dropped when the novel Coronavirus was identified in mind January. Secondly, the AUD dropped again when Wuhan went under lockdown and thirdly the AUD fell when the global pandemic was declared.

Therefore, it can be seen that as the number of coronavirus cases rose, the value of AUD fell. The fourth and fifth major drop-off points in the value of AUD in late February and early march represent the global stock market crashes that affected the entire world.

It was after this point in late March when the APRA issued a notice to the banks advising them to either reduce their dividend payments or suspend them all together in order to fortify their liquid reserves to prepare for the impending financial crash.

2. Impacts on Businesses

Around 43% businesses in the hospitality sector have either sacked or furloughed their workers whereas almost 70% businesses have reduced the working hours of their workers in the hospitality sector, which is globally one of the worst-hit sectors including the airline and tourism sectors.

Around two-thirds of all businesses in the USA have been directly or indirectly hit and have felt a reduction in cash flow and profitability according to a report by the guardian.

Read More: Global Financial Crisis Reoccurring Problem

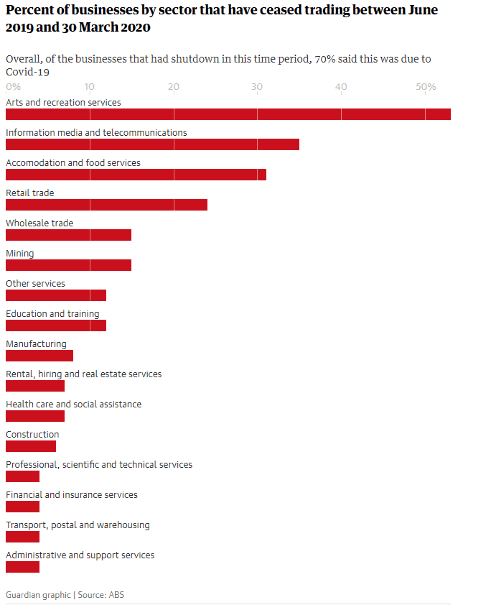

This figure shows the percentage by sectors of businesses that have ceased trading during this period. It can be seen that out of 10 worst affected sectors 8 sectors belong to the services sector and only 2 belong to the primary and manufacturing sectors. Moreover, it is the consumer sector that is the most affected and this is a warning signal for the economy.

The highest number of businesses that have shut down is in the consumer sector. If this results in a contraction in aggregate demand then this can very well create the Great Depression-like a scenario for Australia.

What happened during the great depression what that because of a credit crunch and stagnating demand, unemployment began to rise and this resulted in the reduction in aggregate demand. As demand fell, manufacturers responded by cutting down supply and this increased unemployment. This triggered a vicious cycle that wiped out aggregate demand from the market. It was at this point that John Maynard Keynes understood that the key to saving economies from this situation rests in government intervention.

Read More: The Economy of Australia

Conclusion

Strategic intervention to create fiscal space by reducing taxes and interest rates can invigorate demand, this is what Keynes proposed, and the world is perhaps is in need of his wisdom once again.

Also Enjoy: Major Challenges Australia Faces over the next 10 Years

Also See : Why is BitCoin Outperforming Stocks?

Hiking While Pregnant: What to Know about Outdoor Pregnancy Workouts

Fun Fact

How COVID-19 has affected the Australian economy to date

Final demand rose 1.7%, with consumers spending 1.1%, businesses investing 2.3%, households investing 1.7%, and public investment 9%